do nonprofits pay taxes on lottery winnings

Whenever you see a dollar from a lottery win please remember that the IRS has taken its 25. All winnings over 5000 are subject to tax withholding by lottery agencies at the rate of 25.

Tax Strategies For Lottery Winners

This is a special COVID.

. Florida New Hampshire Tennessee Texas South akota Washington and WyomingFive states do not have a lottery. Enjoy flat rates with no-surprises. Your recognition as a 501 c 3 organization exempts you from federal income tax.

This potentially leaves a gap between the. Therefore your winnings are taxed the same as your wages. The IRS takes 25 percent of lottery winnings from the start.

All winnings from the lottery are subject to tax but its not as simple as paying for it the year you won. However if your newfound wealth puts you in the top tax bracket this. The simple answer is yes.

So even if you could direct your winnings into a trust fund to avoid paying taxes that 25 percent would be withheld. You must pay federal income tax if you win. Yes nonprofits must pay federal and state payroll taxes.

If youre a UK tax resident youre exempt from paying the following taxes on your lottery winnings. The states that do not levy an individual income tax are. Up to 13 can be withheld in local and state taxes depending on where you live.

For both federal and state tax purposes lottery winnings are treated as ordinary taxable income. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. According to CNN Money prize money is taxable income.

But nonprofits still have to pay. The lottery winnings were paid two or more persons may still share in the taxation of the lottery winnings provided there was an agreement to share in the lottery winnings. Lottery winnings are taxed just like income and the IRS taxes the top income bracket.

That means your winnings are taxed the same as your wages or salary. Rather than an income. If you take its annuity value youll have to pay taxes every year.

Most prize winners pay a fixed federal income tax rate of 24 on their lottery winnings over 59999. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members. If you win in 2020 and give the winnings to a public charity you can claim a deduction for 100 of what is basically your adjusted gross income.

For example lets say you elected to. Gambling and Lottery Winnings do seniors pay taxes on lottery winnings Class of Income. And you must report the entire amount you receive each year on your tax return.

For example if you are single and have a taxable income of 40000 and win a 1 million lottery your total taxable income would increase to 1040000 for the year if you take the payout as a. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members. Phew that was easy.

We never bill hourly unlike brick-and-mortar CPAs. How much you earn. Gambling and lottery winnings is a separate class of income under Pennsylvania.

Section 671b of the Tax Law and Section 11-1771b. But if the Pool members were entitled to the. The Internal Revenue Service considers lottery money as gambling winnings which are taxed as ordinary incomeThe total amount of tax you pay on your lottery winnings.

No Nevada Lottery Because Gaming Doesn T Want Competition Las Vegas Review Journal

No Nevada Lottery Because Gaming Doesn T Want Competition Las Vegas Review Journal

Winner Of 1 28 Billion Lottery Gets 433 7 Million After Tax

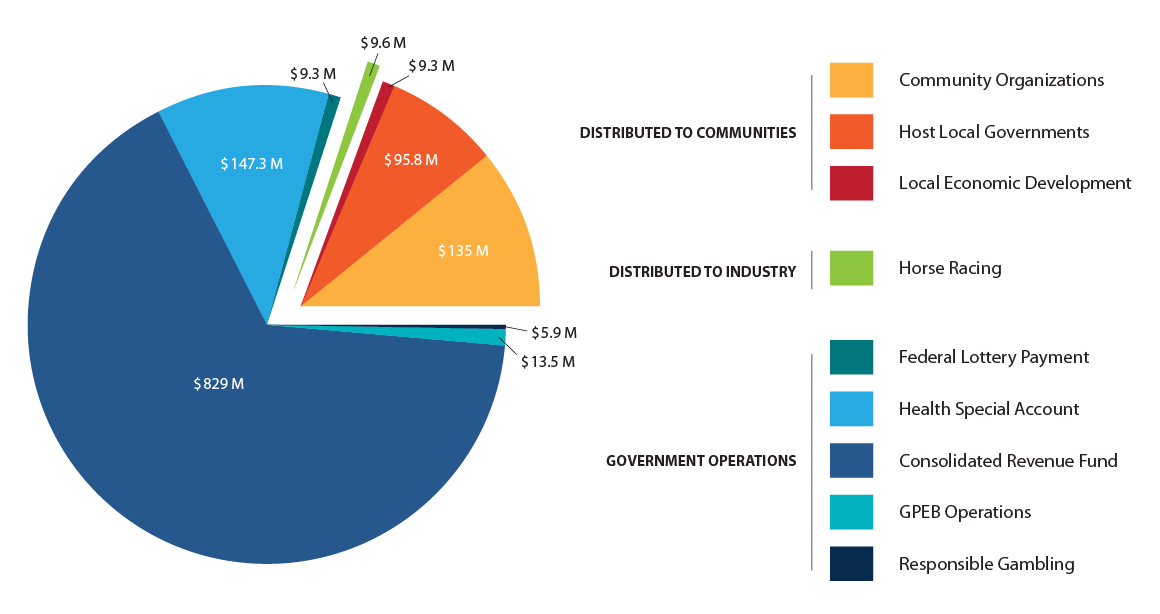

Gambling Revenue Distribution Province Of British Columbia

How Much Can You Give To Charity Tax Free If You Win The Lottery

Monday Map State Local Taxes Fees On Wireless Service Online Lottery Lottery Infographic Map

The Top 12 Biggest Jackpot Winners Of All Time

Lotteries Casinos Sports Betting And Other Types Of State Sanctioned Gambling Urban Institute

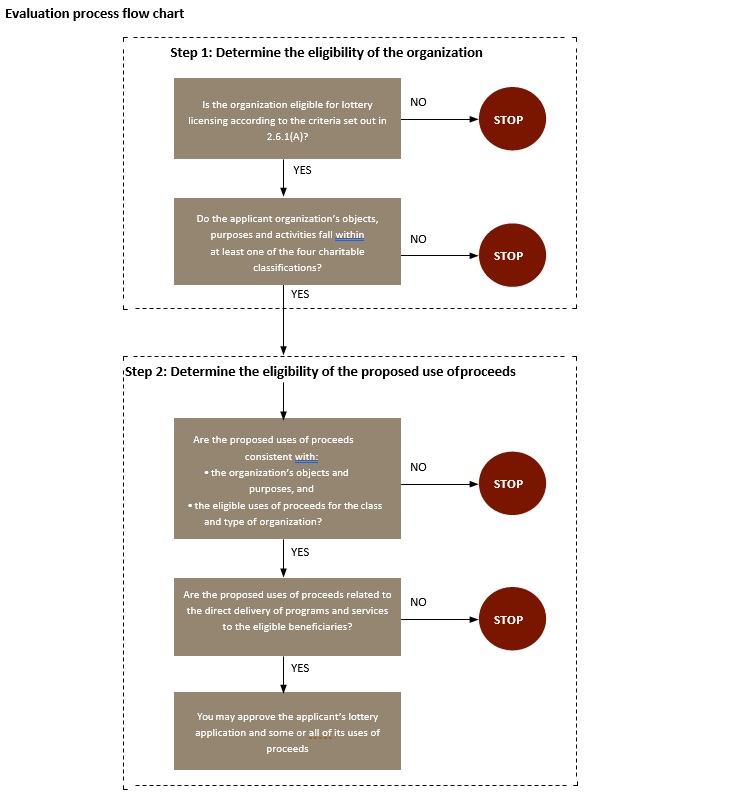

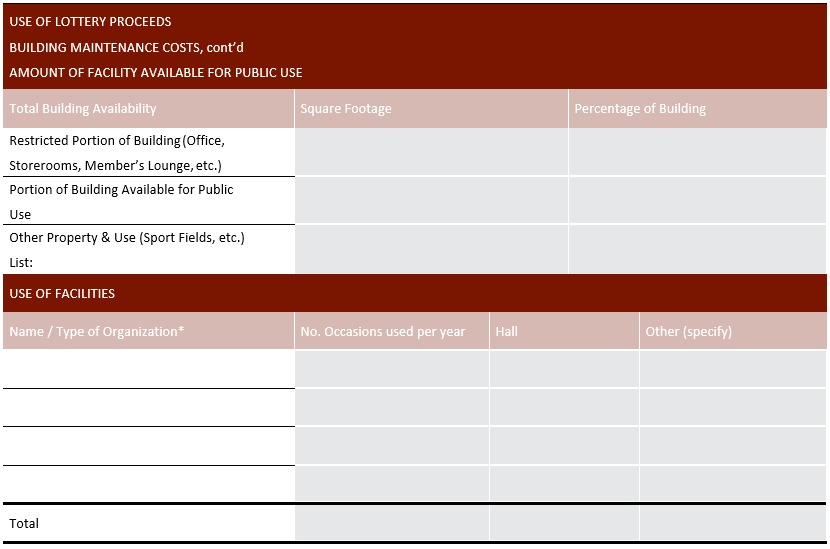

Lottery Licensing Policy Manual

Lotteries Casinos Sports Betting And Other Types Of State Sanctioned Gambling Urban Institute

Taxes On Lottery Winnings Lottothrill

Lottery Winners Should Start A Private Foundation No Really Vox

You Won The Lottery Here S What You Should Do Now Gordon Fischer Law Firm

If You Win The Lottery And Donate It All To Charity Do You Owe Taxes Quora

All You Need To Know About The Powerball Lottery Powerball Lotto Tickets Lottery

What Other Countries In This World Doesn T Tax Lottery Winnings Until You Earn Interest Other Than Australia Quora